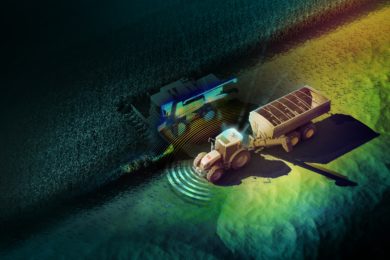

Danfoss Power Solutions has partnered with Swift Navigation, Bonsai Robotics and HARD-LINE to expand the offerings in its autonomous machine development platform.

Danfoss will integrate the companies’ solutions into its PLUS+1 Autonomy software, enabling users to enhance their autonomous machines with Swift Navigation’s high-precision positioning service, Bonsai Robotics’ camera-based vision systems and HARD-LINE’s tele-remote operations solution, the company said.

Peter Bleday, Head of Autonomy, Danfoss Power Solutions, said: “Autonomous off-highway machines are becoming more sophisticated. As we advance towards Level 4 and even Level 5 autonomy, high-precision navigation and remote control beyond line of sight will become requirements. Swift Navigation, Bonsai Robotics and HARD-LINE are very different companies that each have a reputation for technology leadership and flexibility. These are natural system partnerships for us and strategic business fits. We look forward to integrating their solutions into our PLUS+1 Autonomy platform and helping our customers stay ahead of the curve in their autonomous vehicle development.”

PLUS+1 Autonomy is a software platform designed to substantially reduce development time and facilitate rapid vehicle prototyping, helping OEMs get autonomous and semi-autonomous off-highway machines to market faster. In addition to its PLUS+1 Autonomy platform, Danfoss offers engineering services and ruggedised hardware. Danfoss Autonomy teams work with customers from concept to production, supporting full machine development.

Swift Navigation’s Skylark precise positioning service offers decimeter-level accuracy from the cloud to PLUS+1 Autonomy, eliminating the need for additional ground infrastructure, it says. It is well suited for industries such as construction, agriculture and other applications that demand high-precision GNSS capabilities. Skylark covers a wide range of major markets, including the USA, Europe, Japan, Korea and Australia.

Brad Sherrard, Executive Vice President, Industrial, Swift Navigation, said: “We are delighted to collaborate with Danfoss, a renowned leader in industrial machine control. Accurate machine control and autonomy rely heavily on precise positioning. Skylark’s exceptional reliability and extensive coverage make it the ideal solution for these applications.”

Bonsai Robotics is a fast-growing startup that specialises in camera-based vision systems for adverse conditions such as heavy dust, debris, vibration and lack of GPS. The system uses cameras instead of traditional positioning systems, enabling greater accuracy at very low cost when navigating the toughest conditions.

Tyler Niday, founder and CEO, Bonsai Robotics, said: “Bonsai’s partnership with Danfoss has allowed us to rapidly integrate with several vehicle form factors in order to add vision-based autonomy and Visionsteer driver augmentation to equipment operating in some of the most challenging conditions. The beauty of PLUS+1 drive-by-wire systems is that an autonomous perception system can drive the PLUS+1-equipped vehicles through CAN bus messages in the same way that a human would use manual controls.”

HARD-LINE offers teleoperation services that enable monitoring and control of machines over the internet. The service complements Danfoss’ radio-based remote-control solutions, which allow operators to remotely control machines within line of sight. Teleoperations are ideal for operators supervising multiple autonomous machines. If a machine stops due to an unknown obstacle, the operator can log in to the HARD-LINE system, navigate around the obstacle then resume autonomous operation without needing to be close to the machine.

Chad Rhude, Vice President of US operations, HARD-LINE, said: “HARD-LINE is excited to partner with Danfoss to provide a teleoperation solution to work in conjunction with their PLUS+1 Autonomy software. We feel that HARD-LINE’s teleoperation solution is ideal for giving autonomy providers the flexibility to remotely intervene when required during the autonomy process. We look forward to adapting our API to integrate into the PLUS+1 Autonomy platform and working with a great company like Danfoss to bring autonomy and teleoperation to a wider industrial