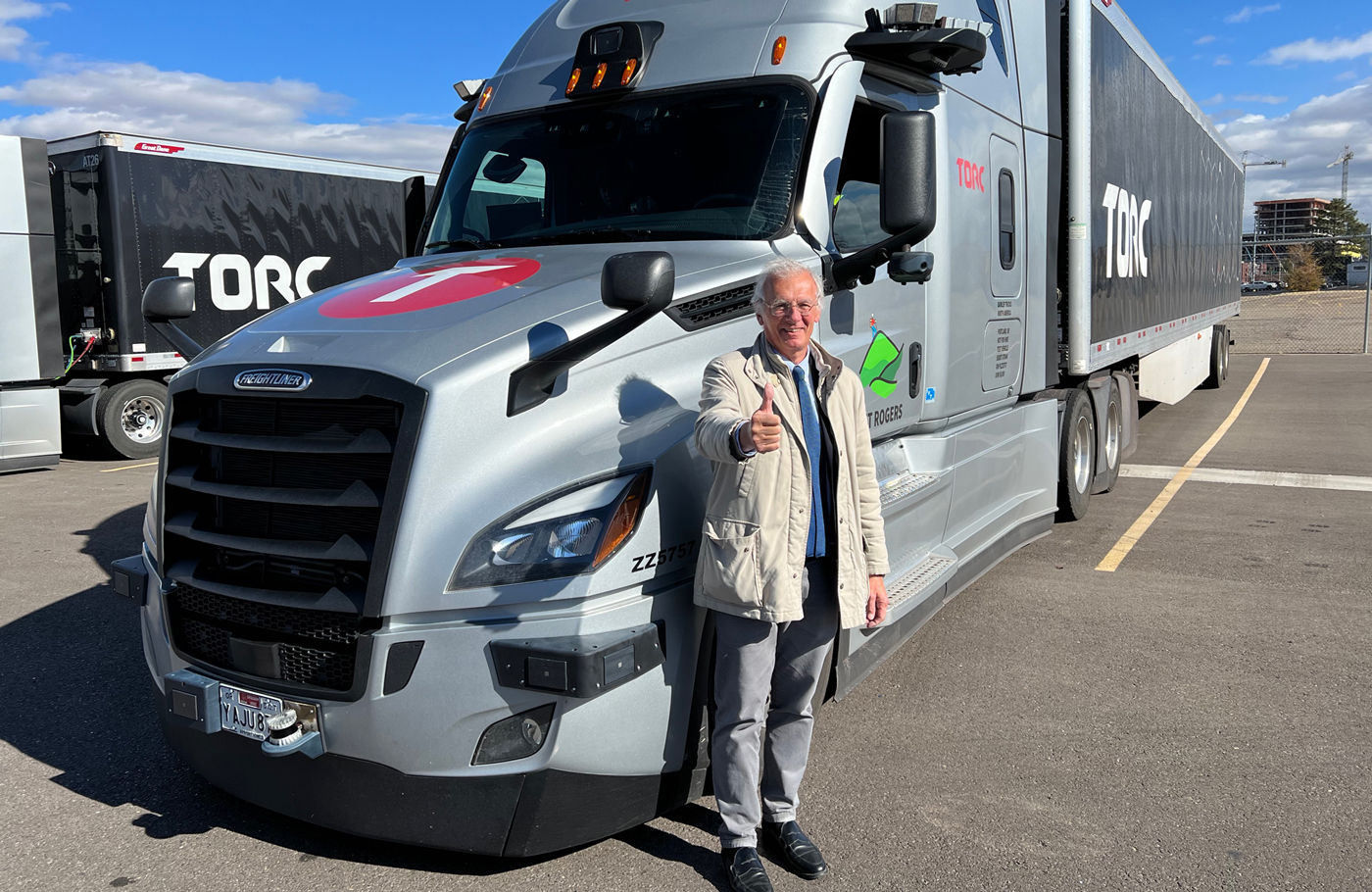

Daimler Truck plans to introduce series-production driverless trucks in the United States by 2030. GIANENRICO GRIFFINI got a taste of things to come when he hopped aboard a Freightliner Cascadia self-driving truck on the highways around Albuquerque, New Mexico, USA.

We don’t have to wait years to see self-driving trucks on public roads. They are already a reality in the United States, with some prototypes based on the Freightliner Cascadia platform. Built by Daimler Truck North America, the Class 8 long-haul trucks, equipped with Level 4 automated driving systems, are undergoing field tests in actual operating conditions on interstate routes around Albuquerque, New Mexico.

Albuquerque is the HQ of Torc Robotics, a company acquired by Daimler Truck in 2019. Torc develops the software and integrates and fuses the inputs from different sensors – such as cameras, lasers, radars, and lidars – to allow safe automatic driving on high-traffic density highways. A lidar is a device that uses a laser beam to measure the distance from an object, returning high-resolution 3D information on the surrounding environment.

ON THE HIGHWAY AT 65 MPH

The validation tests are not held in confined areas, but on multi-lane highways. The tests are conducted using a standard tractor-semi-trailer combination of 80 000 pounds (about 36 tonnes) running at the US maximum cruising speed of 65 mph (just under 105 km/h).

For safety reasons, a human safety driver assisted by a Torc Robotics engineer is always ready to take complete control of the articulated lorry if a risky situation arises during road tests. The safety driver also has a crucial role in providing the software specialists with the feedback needed to program the onboard computer according to a prudent, safe, and fuel-conscious driving style, without hard braking and harsh accelerations.

WHY THE UNITED STATES?

Daimler Truck’s decision to develop autonomous driving solutions first in the United States depends on multiple factors. Firstly, the US has the most branched and extensive motorway network globally, while the speed difference between trucks and cars is not as high as in the EU.

Moreover, US highways represent a more structured environment than an urban setting. There are lanes headed in the same direction, and it’s easier to predict where cars are supposed to be going. In this environment, the Freightliner Cascadia can handle most traffic situations: lane merges, merging into traffic from a ramp, changing lanes, and slowing down or speeding up.

The US legislative framework is also favourable, since the only counterpart to the truck manufacturers is the US Department of Transportation (DoT), which is proactive in facilitating the introduction of technical innovations.

Furthermore, self-driving 18-wheelers respond to clear business cases and market needs, such as a continuous increase in freight demand transported by road (a 30% increase is expected by 2030) and a growing shortage of heavy vehicle drivers. According to American Trucking Association (ATA) estimates, unfilled driver jobs slid to just under 78 000 units in 2022, down about 4% from more than 81 000 in 2021. This is still a considerable number, which according to ATA forecasts is bound to skyrocket to more than 160 000 units by 2031.

The driver shortage is due, among other reasons, to a significant number of retirements and the industry’s failure to recruit more women, who account for only 8% of the overall workforce.

WHY THE UNITED STATES?

Daimler Truck’s decision to develop autonomous driving solutions first in the United States depends on multiple factors. Firstly, the US has the most branched and extensive motorway network globally, while the speed difference between trucks and cars is not as high as in the EU.

Moreover, US highways represent a more structured environment than an urban setting. There are lanes headed in the same direction, and it’s easier to predict where cars are supposed to be going. In this environment, the Freightliner Cascadia can handle most traffic situations: lane merges, merging into traffic from a ramp, changing lanes, and slowing down or speeding up.

The US legislative framework is also favourable, since the only counterpart to the truck manufacturers is the US Department of Transportation (DoT), which is proactive in facilitating the introduction of technical innovations.

Furthermore, self-driving 18-wheelers respond to clear business cases and market needs, such as a continuous increase in freight demand transported by road (a 30% increase is expected by 2030) and a growing shortage of heavy vehicle drivers. According to American Trucking Association (ATA) estimates, unfilled driver jobs slid to just under 78 000 units in 2022, down about 4% from more than 81 000 in 2021. This is still a considerable number, which according to ATA forecasts is bound to skyrocket to more than 160 000 units by 2031.

The driver shortage is due, among other reasons, to a significant number of retirements and the industry’s failure to recruit more women, who account for only 8% of the overall workforce.